The Family Office... What an extraordinarily elusive concept. Just google the term and a host of headlines attempting to explain this trend - particularly in Singapore and China - appears. However, what does it actually do?

Even before the 'Family Office' concept became popular in Asia, we were working hard as a multi-family office (which represents more than one family). Many people, including extremely wealthy families and not-so-wealthy individuals, asked us what family offices do. Some people asked how to set up a family office. In this article, we provide our two cents' after more than a decade in the business.

Family Office Roots

The Family Office started way back in the 6th century in the halls of kings. Back then, the king’s steward was responsible for managing the royal wealth. Later, aristocrats continued the custom which created the concept of ‘stewardship’ as we know it today.

The modern concept of the Family Office, however, can be dated to the 19th century. In 1838, the family of financier and art collector, J.P. Morgan founded the House of Morgan to manage the family assets. In 1882, the Rockefellers founded their own family office, which is still in existence and provides services to other families.

Today, there are at least 3,000 single-family offices in existence globally; more than half of these were set up in the last 15 years. Singapore alone currently has about 700 family offices, up from 400 in end-2020 and up sevenfold from 2017.

We all know and love the brand Chanel, but did you know that Mousse Partners is the family office responsible for investing proceeds from Chanel?

Here’s another one for you - you may wear it, but you may not know that Pontegadea is the family office behind the multi-national retail clothing chain ZARA.

Understanding and discovering family offices can be fun!

What does a Family Office do?

Note: Ernst & Young

At the end of the day, no two family office is the same. Every family office will be unique as it is specifically set up to meet the needs of that particular family.

As seen from the picture, a family office can possess investment functions, manage a family’s luxury assets or properties, further philanthropy or basically pass down the family values and wealth to the next generation. As such, there is no single model of a family office, and that adds to the beauty and mystery surrounding this industry.

“Wealth does not last beyond three generations”

Ensuring that the curse “Wealth does not last beyond three generations” does not befall one’s family is harder than it seems. The CEO of a London-based family office is quoted saying:

How easily does your family talk about inheritance and hopes and dreams? These things are so personal that it’s very difficult. A few years ago we had discussions with the family where we tried to articulate values. The result was something that we struggled to embed into the family office. It’s very difficult, and especially so for the finance professionals who are used to dealing with less emotional topics.

Note: Global Family Office Report 2023, UBS

The pressing need to ensure proper stewardship of the hard-earned wealth of the first generation is reflected in this survey done by UBS. Unfortunately, only 42% of family offices have a wealth succession plan and a governance framework for family members. In fact, 51% of family offices serve the first generation, 55% the second and 31% the third. Family offices in the US and Switzerland tend to have more multi-generational family offices than in Asia-Pacific.

Separation of Functions

Concierge Function

As discussed earlier, the origin of the Family Office was the stewardship of the wealth of a family. Thus the Family Office in its purest form serves as a concierge to a single family, where the family enjoys the following:

Administration services

Support for various lifestyles of family members

Management of philanthropic activities

Coordinating the family efforts to educate the young generation

and so on…

However, as generation after generation take over the reins of management and control, it is difficult to retain the original intent. As the family expands, needs and wants vary. There is an increased cost to meet wider demands. Although a single-family office may choose to merge with another family to become a multi-family office, this may reduce costs, but it will also compromise on the original purpose of supporting the needs of the founding family.

Asset Management Function

The Family Office can also serve a primary asset management function. In this scenario:

The Chief Investment Officer is appointed as a person that all family members trust

There are dedicated investment professionals

Family members are interested in investing as a profession

There is an internal performance evaluation for the asset management

and so on…

Once again, if the family gets too big, costs increase to hire external talented professionals. The family may also choose to manage the wealth of other families in order to reduce overall costs.

There is no perfect scenario - each family has to weigh the pros and cons of its setup and decide what is the best approach for itself.

Private Bank, Multi-Family Office, and Single Family Office

When a family accumulates a significant amount of wealth, an important but challenging question arises: “Should we set up a family office or stay with our private bankers?” An answer to this question varies, depending on what you want to achieve with your own wealth, and how much you are willing to pay.

If your family has more than a $10 bn net worth, it is recommended to set up a single-family office, form a multi-family office or join an already-established multi-family office because private banks are very expensive option. Private banks offer a turn-key solution to your wealth management, but there are many visible and invisible costs. On the other hand, setting up one’s own single-family office could be time-consuming and messy. Your family needs to hire an experienced management team, including Chief Investment Officer, and an entire team who can provide a concierge function or asset management function, or both.

The following table shows the pros and cons of three forms of managing your own wealth.

Operating a Full-Scale Family Office

This is a sample organizational chart of a full-scale family office. Realistically speaking, you can set up your own family office with just a handful of people in your family. As mentioned above, customize your family office setup according to your needs, wishes, and resources.

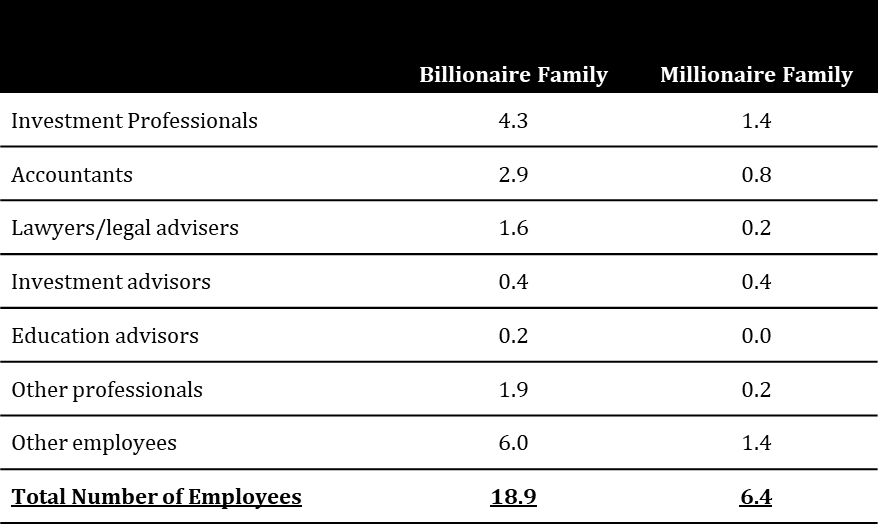

Note: Wharton Global Family Alliance

At the same time, most family offices are relatively small in size. According to Wharton Global Family Alliance, a typical billionaire family office hires only 18.9 people while millionaire family office 6.4 people.

Note: UBS

According to UBS’s “Global Family Office Report 2023”, the pure cost of operating a family office in 2023 was 0.381% of asset under management (”AUM”). There is a scale of variations in cost, depending on the size of assets under management. Smaller family offices ($100-250 mm) cost proportionately more to run at 0.466% of AUM.

The largest cost of running a family office is staff cost, which takes up 69%. A typical family office ($1 bn AUM) spends $2.6 mm for employees, which is 0.26% of AUM. If the family office employs 18.9 professionals, the average compensation is $140,000.

60% of family offices pay a discretionary bonus and 47% a performance-linked bonus. In US, there is more of a bonus culture: 76% of family offices pay a discretionary bonus and 69% a performance-linked bonus.

Growing Family Office Landscape in Asia-Pacific

The family office landscape in Singapore is booming. A CIO of a Singapore-based family office is quoted to say:

“Costs are going up driven by the fact that there are 700 new family offices in Singapore and if they all hire two to three people that’s a huge part of the talent pool in a small country. I have heard of people getting 20-30% of their previous salary to sign on, and a guaranteed bonus.”

As mentioned above, there are at least 700 family offices in Singapore today, and the number is growing. However, compared to Europe and North America, the family office industry in Asia-Pacific is still at its infancy. For example, the average size, measured by Asset Under Management (AUM), of Asia-Pacific family offices is almost half of the Global average.

Note: “The Asia-Pacific Family Office Report 2022”, Campden Wealth

Asia is home to 38% of billionaires listed in the Forbes World Billionaires List 2022, and this is an increase of 17% since five years ago. However, compared to Europe and North America, the average size of family offices in Asia-Pacific is still small. To put things in perspective, 80% of Asia’s family offices were founded after 2000.

According to Campden Wealth’s survey, about 60% of family offices in Asia-Pacific are single-family offices, but only 41% were professionally set up. This is much lower than the Global average of 56%. Many single-family offices are still embedded in the operating businesses owned by the same families and very often led by the heads of finance and accounting departments of the operating businesses. They are often not as financially sophisticated as the management teams of the independently operated single-family offices.

Note: “The Asia-Pacific Family Office Report 2022”, Campden Wealth

Reference:

‘Single family office, independent’ is an independent family office from the family business

‘Single family office, embedded’ is a family office embedded in the family business

‘Virtual family office’ is a family office that hires only 1-2 staff and outsources the bulk of its work

‘Private multi-family office’ is a family office owned by more than one family and operated for their benefit

‘Commercial multi-family office’ is a family office owned by commercial third-parties

An independently managed family office should look like the following chart. There will be a separate legal entity from a fund or pool of capital owned by family members. Investment professionals are employed by the family office entity which provides management services in exchange of management (and sometimes incentive) fees.

Note: Sovereign Group

Singapore, a New Hub for Asia-Pacific’s Family Offices

The Family Office scene in Asia-Pacific is still nascent and has great potential for growth. And that is why Singapore wants to seize this opportunity to present itself as the hub of Asia’s Family Office industry. The Singapore government has implemented attractive tax schemes (called Section 13O and 13U, in addition to its competitive corporate tax rate of 17%) to encourage the set up of family offices here. The Hong Kong government also launched a similar incentive program to attract family offices to be established there as well.

For example, if a family office manages the wealth of a single family, it is often exempted from being regulated by the government. Qualified family offices can also claim a 100% tax deduction for their overseas donations made through qualifying local intermediaries, capped at 40% of the donor’s statutory income.

In conclusion, there is a great opportunity for wealth creation, wealth preservation, and wealth transfer in the Family Office industry in the Asia-Pacific. Star Magnolia Capital is glad to be a part of this exciting space and we look forward to being a part of the many upcoming developments in the region.

Links:

“Family Office, Explained” by Star Magnolia Capital

“Global Family Office Report, 2023” by UBS

“The Future of Wealth and Growth Hangs in the Balance” by MicKinsey Global Institute

“The Asia-Pacific Family Office Report 2022” by Campden Wealth

“The European Family Office Report 2022” by Campden Wealth

Please also read:

We Are Experts of Nothing, But Finding Experts

Two Professors Prof. Lauren Cohen is a leading scholar and educator at Harvard Business School. We were introduced to Prof. Cohen by Prof. Tony Gao at Tsinghua University PBC School of Finance (Tsinghua PBCSF), who is undoubtedly the most prominent academic researcher for family office research in China. In 2012, Prof. Gao was appointed as Director of th…

Preserving Legacy for Families

Brandywine Creek Brandywine Trust Group, LLC, a multifamily office, which manages over $10 bn, is located within a few minutes from the Brandywine Creek, where General George Washington lost a critical battle against the British Army. This defeat resulted in the fall of Philadelphia, then the American capital. Today’s Brandywine Creek is a picturesque na…

Wealth, Caution

Wealth, Caution In 2011, Forbes estimated the top 400 Chinese families had amassed over $450 billion net worth (vs. $1.3 trillion of the 400 richest American families). Not the amount, but the speed of wealth accumulation catches our eyes. The wealth of the Chinese families grew 166% from the pre-crisis level in 2008, raising the minimum tic…

Interview with Shinya Deguchi

Tiffany Liu: Shinya, thank you very much for this interview. I’m quite excited to be a part of Project Z. Before talking more about the details of Project Z, could you tell us about yourself? Shinya Deguchi: Sure! I was born and raised in a small Japanese town called Tamaki. It is close to Ise and Matsusaka, both famous for gourmet food. Ise is known for…

Regarding the numer of family offices in Singapore, I have seen it so many times over the past couple months, and was wondering how many of that amount of FOs operate like a true FO; As far as I know, this sudden increase in Singapore is largely due to the 13O and 13X policies, and most of the FOs were setup for the purpose of applying employment pass visa in Singapore; The way they operate in essense is not different from simplying settup a private bank account;