Tiffany Liu: Shinya, thank you very much for this interview. I’m quite excited to be a part of Project Z. Before talking more about the details of Project Z, could you tell us about yourself?

Shinya Deguchi: Sure! I was born and raised in a small Japanese town called Tamaki. It is close to Ise and Matsusaka, both famous for gourmet food. Ise is known for Ise spiny lobster and Matsusaka for Matsusaka beef. My grandfather owned a pharmacy, and later my mother took over. My sister also became a pharmacist. I didn’t want to be a pharmacist, and as it turned out, biology and chemistry were my worst subjects at junior high. I went to Tokai High School in Nagoya, about an hour from my hometown. Our school was very competitive. From my class of 40 students, 5–6 went to Tokyo University, 5–6 went to Kyoto University, 10 went to Waseda, Keio and Hitotsubashi. All are “elite” schools in Japan. I was the only student who decided to study abroad. My teacher said, “it’s good that you are studying abroad, but we don’t know how to help you.” So, I had to do everything by myself to apply for university.

TL: So, what happened then? How did you decide which schools to go?

SD: I wanted to study economics and wanted to go to the United States. But, I hated English. I didn’t want to go to top universities then struggle, and I thought if I wanted, I could transfer later. So, I picked three schools and was accepted by all three. I decided to go to George Washington University because I wanted to see Washington, D.C. I finished most of my undergraduate courses in two years and got a permission from the dean to take graduate-level economic courses. They were so much more fun! I studied with professionals from World Bank, IMF and Federal Reserves, who attended those classes part-time.

TL: After graduating from the George Washington University, you joined Melco Holdings. What did you do there?

SD: Melco Holdings is a Japanese company in Nagoya, which makes computer peripherals. They have the top share in wireless Lan in Japan. I knew about the company because it was started by the father of my friend in high school. Melco’s founder, Makoto Maki (牧誠), was different from other typical large company owners — very innovative and forward-looking. Their business was highly successful, and it had too much cash on the balance sheet. If this were in the United States, cash-rich companies would be pressured to buy back shares or pay dividends. But this was in Japan, and Maki family controlled almost 50% of Melco’s outstanding shares. So if Melco paid out dividends, they would have to pay tax on those shares. But on the other hand, they didn’t want to buy back shares because it will increase the family’s ownership in the company. In the end, they decided to invest the cash in hedge funds. I joined Melco to help the company’s investment activities and I was “seconded” to a fund-of-funds in Greenwich, Connecticut, to learn the business [you need to explain why you were in the U.S. although you worked for a Japanese company].

TL: But, you left Melco in three years and joined Cook Pine Capital. Why?

SD: After one year, my friend, Hiroyuki Maki (牧寛之), joined the company and we started working together, and we both realized friendship and business partnership were quite different. We started arguing a lot on small things because we had different views. Then our portfolio started having problems because the investment advisor we hired in the United States turned out to be bad. Melco asked me to come back to Nagoya, but I had met my future wife in New York. So that was it. I decided to stay and I left. The problem was… I didn’t have a job. I felt bad about looking for a new job while I was still working at Melco, so I only started looking after I quit. Finally after 9 months of no job, no income, I met Cook Pine Capital. Cook Pine Capital is a multifamily office/investment advisor also based in Greenwich, Connecticut. Yumi and Eiichiro Kuwana (桑名由美・桑名英一郎) started the company in 2004. Before setting up Cook Pine Capital, Eiichiro was one of the senior managers at Goldman’s private wealth business and was also the head of the private wealth business in Japan. Cook Pine Capital had very good relationships with some of the wealthiest families who had assets globally, and we helped them to manage their portfolios through investing in hedge funds and private equity funds. I worked there for more than 6 years from 2006 to 2012.

TL: Then in 2012, you left Cook Pine Capital and moved to China. Why?

SD: It’s a long story…but I will try to tell you a shorter version. My father took me to Shanghai in 1993 when I was 13 years old. It was my first trip overseas. At that time, thanks to Deng Xiaoping’s efforts, China was just starting to re-develop the country, but it was still too early to tell. Pudong was basically a big flat land with one tall TV tower. I remember looking at the tower from the Bund where there were many historical European buildings. Nobody really knew what was happening in China. Even Chinese people didn’t know what would happen in the next 25 years. I saw life in Shanghai was quite poor compared to that in Japan, which was right in the middle of the “Bubble” period. But, I liked Shanghai and the people there a lot. And, the food was great! I really liked the braised pig knuckle (红烧蹄膀). Everybody seemed so humble and hardworking. I felt a lot of good vibes in China, so the following year, I asked my father if I could go to China again. He said OK and asked his friend to accompany me. We spent two weeks, visiting Beijing, Xian, Chongqing and Shanghai. At the beginning of the trip, I didn’t like the typical breakfast of soy milk and fried dough… I didn’t get it. But, after two weeks, I was converted. Even today, doujiang (soy milk, 豆浆) and youtiao (fried dough, 油条) are my favorite breakfast food. When we arrived in Shanghai, I noticed immediately that there were already more buildings in Pudong, not just that TV tower. It was only a year since my first trip and I couldn’t believe how quickly everything was changing. In the year after, I went back to Shanghai again and saw more changes. It was very exciting: very different from what I knew about China. I read a lot of manga, and one of my favorites was a series of manga, 60 books in total, based on the Chinese classic, “The Romance of Three Kingdoms (三国演义),” by Mitsuteru Yokoyama (横山光輝). I read them over and over again for more than 20 times. So, although I went to study in the United States, I never forgot about China.

So, that was the “short” introduction. In 2012, everybody in the United States was very negative on China, kind of in a denial regardless of China’s amazing growth and rising status as the world’s super power. I knew that was wrong because I saw the growth from the very beginning. Around the same time, Japanese economy was very bad, after many years of mismanagement. I thought it was the time for me to switch my focus from the United States and Japan to China. For nine years, I had worked with Japanese families to manage their wealth, and what I had realized was that most of Japanese families did not really know how to manage their money. They believed in real estates and, as a result of the bubble burst, lost a lot of money. Japanese families were afraid of investing overseas and so they just let their money sit in bank deposit with 0.00001% for decades. Chinese families were following a similar path as Japanese families did 20–30 years ago. Most of families held a lot of money in real estates and were not diversifying enough. I wanted to help Chinese families avoid making the same mistake. I discussed my views with Eiichiro and left the Cook Pine Capital to establish Star Magnolia Capital on my own. He was extremely supportive for my next step.

TL: Interesting story. So, how did you get involved with Investor Z?

SD: In Asian cultures, talking about money is a kind of taboo. Parents don’t talk about money in front of children. It’s just like Zaizen’s family in Investor Z. When I was in New York, I had met several Jewish families, and they thought differently. Jewish parents actually told their children how rich they were and they didn’t need to work for the rest of the lives. However, they also stressed that the money was not coming for free, but with responsibilities.

TL: What kind of responsibilities?

SD: First of all, the children are taught that they are responsible for the next generations. The family money did not come out of thin air: it came from their grand parents and great-grand parents and all the previous generations. The current generation can use the money, but they also need to leave money for the future generations. That means the money must grow. In the asset management world, the biggest risk is not the markets, but inflation. The family wealth will be depleted if their assets are not earning enough to overcome inflation. So, the children must learn how to manage their portfolio and invest wisely. In addition, the children are taught that they are responsible to the society. Without the supports of the society, they cannot survive and flourish. The society does not mean only their families or close friends, but all kinds of people. Therefore, Jewish families organize their own summer camps where there are many programs to teach children about money and investing as well as social responsibilities. I’ve never heard of such unique money management education in Asia, definitely not in Japan.

TL: I see. So, you realized that investment education is very important.

SD: Yes, that’s correct. And, it is not only for rich families. When I was a university student, I read a book called “Rich Dad, Poor Dad” and I went to the seminar hosted by the author, too. The concept was very simple. If you do not invest, you will never get out of the rat race and will stay poor forever. It was not the amount of money you invest, but your mindset.

TL: But, you haven’t explained anything about Investor Z.

SD: OK, that was, again, the introduction. So, I had realized investment education is important, but it’s a very difficult subject to teach. Children study because of exams. That is especially the case in Asia. They won’t voluntarily study “investing” for no reason. So, the key question is how can we make them interested in investing? Then, I read “Investor Z.” I was really impressed by the depth and thoughtfulness of the contents and I couldn’t believe that comic books about investment were actually popular. I asked my father to read it. He is almost 70 years old and never reads comic books, but he loves investing. He finished all 21 books in a few days and announced, “this is going to be my bible for the rest of my life.” In fact, my father had been trying to make my sister, who had never taken any business and finance-related classes, to learn about investment for the past ten years without success. My father wanted her to manage her own money though investment because he believed that it was the best way to learn how the world was functioning. She never paid any attention. So I told my father that I would take a different approach and I asked my sister to read “Investor Z.” After a few weeks, she asked me, “Hey, how do I invest? How do I can I open a brokerage account? I want to buy a stock.”

TL: Wow. So, it worked really well.

SD: Yes, indeed. Comic book, or manga, is a great way to learn a difficult subject because the format is easier and more accessible. If I asked my sister to read the annual letters of Berkshire Hathaway, even if it is translated into Japanese, I can wait for eternity and it would still not happen. But, manga is different. As opposed to written reports, manga engages the reader directly and visually with pictures. Anyway, getting my sister interested is only the beginning. The interest must be cultivated and developed step by step. There are also some details which Investor Z doesn’t explain in the story, such as how to buy or sell stocks. Today, my family has a weekly investing meeting where we discuss our investments. My father is very pleased.

TL: But, it’s a story of “your” family… why are you doing this in China?

SD: I think Investor Z can help our business in China. The most difficult part of our business is introducing and educating proper investment disciplines. Most of families are either too aggressive or too conservative. Understanding the concepts of investment — such as inflation, diversification and risk management helps us to build a long-lasting relationship. Using Investor Z as a platform, we can also introduce study session, like the one my family has, to the next generation so they can learn about the correct way of managing their money, which is a big concern of our clients. So, I asked Mr. Sadoshima at Cork, who is an agent for Investor Z, to see if we could translate it into Chinese.

TL: Then what did Mr. Sadoshima say?

SD: He said yes, but also suggested we should work together to promote Investor Z on a larger scale in China. To be honest, I initially I thought, “why me?” I didn’t know anyone in the media industry, China or anywhere. It was completely outside of my field. Moreover, I knew selling books no longer made money. Digitization changed the business model of music, books and all. It’s difficult to sell books now because people read them on electronic devices, and the old business model of selling books must change.

TL: Can you elaborate on this more?

SD: So, I convinced Mr. Sadoshima that we should distribute the comic books for free and earn money and compensate the author, Mr. Mita, in other ways. For example, we can use Investor Z to create investment educational programs for China’s financial institutions as they need to provide additional services to enhance engagement with their customers. This type of licensing revenue could be significant if Investor Z is recognized as a trustworthy brand for the investment education.

TL: I’m still surprised that they said OK to share the contents for free.

SD: Yes, I was, too. I didn’t expect he would say OK right away. Most of publishers would probably said no, but luckily, Mr. Sadoshima and Mr. Mita were different and forward-looking. They understood why the business model needed to change and why my approach would work for the generation we are targeting.

TL: I understand you are creating Project Z as an impact investing. Can you explain what impact investing is?

SD: Sure. Impact investing is similar to charity as it aims to create positive social impact. But at the same time, it is different because it is “for-profit” so that it can support the project itself and create sufficient financial incentives. It is a new way to pay back to the society. As Investor Z says, money-making is not bad in itself. In fact, it is an important driver for the human society. My proposition is that we invest in Project Z, and Project Z teaches people proper ways to invest and thus creates beneficial social impact; and at the same time, the Project generates financial returns for us and for our partners. The students and families who have participated in our program will be able to use what they have learned and return their knowledge in the market, while we will re-invest the profit in Project Z and other projects to further develop the investment education in China. The idea is to create a positive, self-reinforcing spiral, and that is our mission for Project Z.

TL: But, how does Project Z impact the society exactly? I don’t think distributing the contents does it all.

SD: No, absolutely not. Investor Z is just a catalyst or a starting point. We are targeting so-called Generation Z (“Gen Z”), or those who were born between 1995–2005. We want as many Gen Z to read Investor Z as possible, and that is why we are distributing it for free. Then, we follow up. Reading Investor Z got my sister interested initially, but if nobody followed up, she would quickly forget and move on to other things. Investing is a particularly difficult subject for Gen Z to follow because there is very little resource to help them. That’s where we come in. We want to create a platform for Gen Z who have become interested in investing after reading Investor Z to teach them the right investment approach, i.e. value investing. Value investment is the key for China’s future growth. But most of the investors in China, in the public equity or private equity markets, are speculators. It’s funny to say this for the private equity investors because they should be, by definition, long-term investors, but they are actually trying to make money in the short run.

That’s not the right approach for the future of China. Take Warren Buffett as an example, his investment time horizon is not even years, but decades. But not many people in China own the same companies or shares for over 5 years. They flip, make a quick profit, and get out. However, those days are, in my view, over. Gen Z needs to know how to make money patiently and for the long-term because what their parents did will not work for them. Many Chinese families made money by investing in properties, but it is not easy to make a lot of money in property markets anymore. The good news for Gen Z in China is that the economic prospect is still very bright. I strongly believe that China will continue growing over the next 20–30 years, and the best way to generate good returns in both private and public markets is still value investing, focusing on the fundamentals and long-term appreciation.

TL: Is that why you are setting up The Z Club?

SD: That’s correct. Let me tell you a little bit about my personal experience for this. It was in 2001 when Maki Sr. called me to drive up to New York to meet some “interesting people.” Interesting people turned out to be some of the famous hedge fund managers in the United States. I was just a 21-year-old kid, studying economics. I had a brokerage account for about two years, but I knew very little about investing and nothing about hedge funds. The meeting with those famous hedge fund managers changed my life because it opened up a whole new world for me. I want to provide similar opportunities for students through The Z Club. We have asked successful investment managers and entrepreneurs in China, whom we call “Z Professors,” to help in our effort to develop Project Z and Gen Z’s future, and have received many positive feedbacks and supports. We are very fortunate in having so many professionals and experts on board, sharing our views and mission and we are extremely grateful. The Z Club members will have special access to the Z Professors and will be able to learn their experience as investment managers directly in a small group. I’m hoping that this experience will have a positive impact on the Z Club members as it did on me. We are also planning to organize a competition on value stock analysis in the future to promote the concept of the value investing. Investment managers will not only be the judges to the competition, but they will also provide guidance to the participating students. May be some of participants will go on to become Warrant Buffett of China one day! That is our hope and wish.

TL: What is the best episode of Investor Z you want to share with readers?

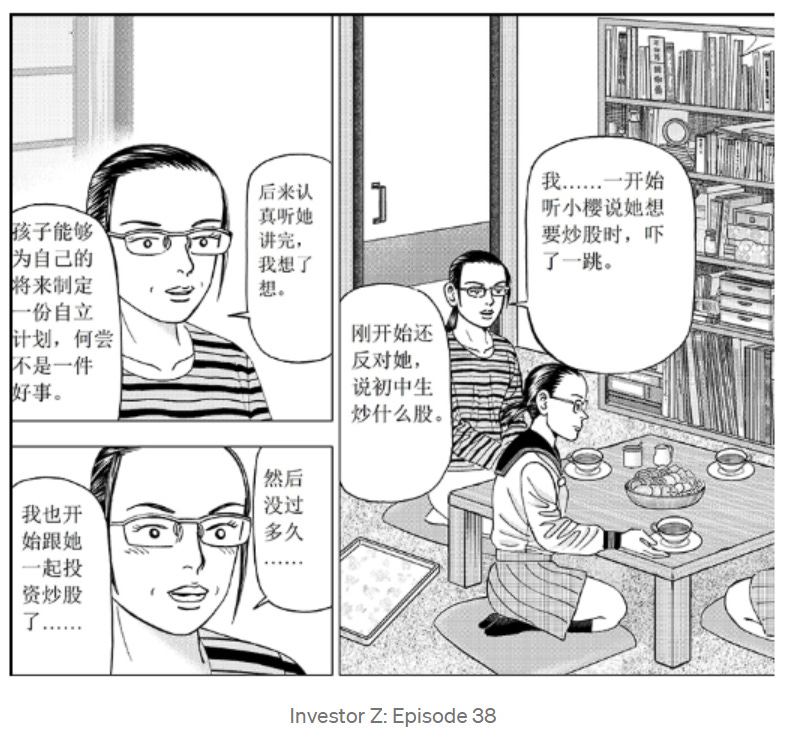

SD: I like episode 38 (妈妈好厉害). This is the first episode where Sakura’s mother reveals that she has started investing. As discussed earlier, investing is not just for the professionals. Everyone can start investing and change their lives like Sakura’s mother. From a helpless single mother, she became an independent business owner. Such miraculous transformation should not be confined to the world of comic books, and I want to create small miracles for everyone in real life!