Two Professors

Prof. Lauren Cohen is a leading scholar and educator at Harvard Business School. We were introduced to Prof. Cohen by Prof. Tony Gao at Tsinghua University PBC School of Finance (Tsinghua PBCSF), who is undoubtedly the most prominent academic researcher for family office research in China. In 2012, Prof. Gao was appointed as Director of the Global Family Business Program at Tsinghua PBCSF, and, in 2015, he led the establishment of the Global Family Office Business Research. I was introduced to Prof. Gao by Mr. Alan Ng in 2019. Prof. Gao approached us in 2022 with a surprising proposal: he is interested in writing a case study about our multi-family office as a joint program with Harvard Business School.

Changing Landscape of China's Family Office Industry

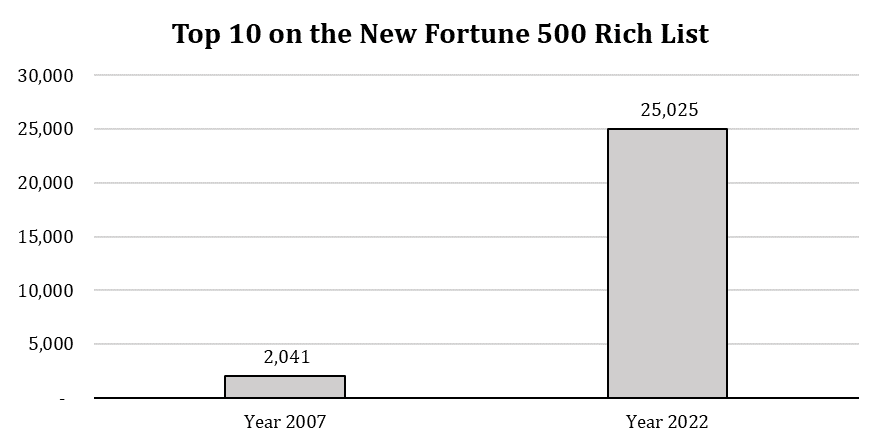

In the very same year Prof. Gao was appointed as Director of the Global Family Business Program, I left Cook Pine Capital in the United States and moved back to Asia, where I saw the unstoppable growth of the net worth of Chinese families. In 2012, according to Forbes China, there were only 198 billionaires. As of 2023, there are 495. In 2007, China did not have a billionaire as the richest person then was, Ms. Yang Huiyan. She was only 24-25 years old, and she had just inherited the real estate dynasty from her father and founder, Mr. Yang Guoqiang. His net worth then was RMB 4.6 bn (approximately, $657 mm at 2007's exchange rate). Today, Ms. Yang is still very rich with $6.6 bn of estimated net worth (Forbes), but she is no longer on the top 10 richest list. In 2007, nearly 80% of the wealth of these families came from the real estate industry. In 2022, the industry disappeared from the list. Instead, we have more families who generated wealth from the technology, consumer, and manufacturing sectors. It shows how China's economy progressed and the real estate sector is no longer the only source of wealth. This is exactly what I warned about in my first article, Wealth, Caution, in September 2012.

In 2012, family offices were not common in China, but the landscape completely changed over the last 10 years. It is no longer a foreign concept for China's wealthy families, but many people still do not know what the sustainable business model for family offices is. It has been more than 10 years since Star Magnolia Capital was established and we are one of the oldest multi-family offices in China. What is the secret behind our longevity?

We Are Experts of Nothing, But Finding Experts

Star Magnolia Capital’s association with Capital Allocators in China definitely helped to convince Prof. Cohen to work on our company’s case study. He recognized that Star Magnolia Capital is one of the first multi-family offices in China that specializes in the endowment approach. During one of the interviews, Prof. Cohen asked me what makes Star Magnolia Capital different. I paused for a second and said “It’s a very good question because we are experts of nothing. But we are good at finding trusted experts and building multi-decade relationships with them. We are not investing in funds. We are investing in people.” Prof. Cohen twisted my words nicely and titled the case study: Becoming Experts at Finding Experts.

https://www.hbs.edu/faculty/Pages/item.aspx?num=63092

Star Magnolia Capital’s endowment approach resembles those practiced at the Yale Investment Office, MITIMCo (MIT), PRIMCO (Princeton University) amongst other institutional investors and family offices. The picture below is a handwritten note by Dr. David Swensen, former CIO of the Yale Investment Office and pioneer of the endowment approach. We also believe that the real secret of longevity is our focus on finding the right people.

Source: Yale Investment Office

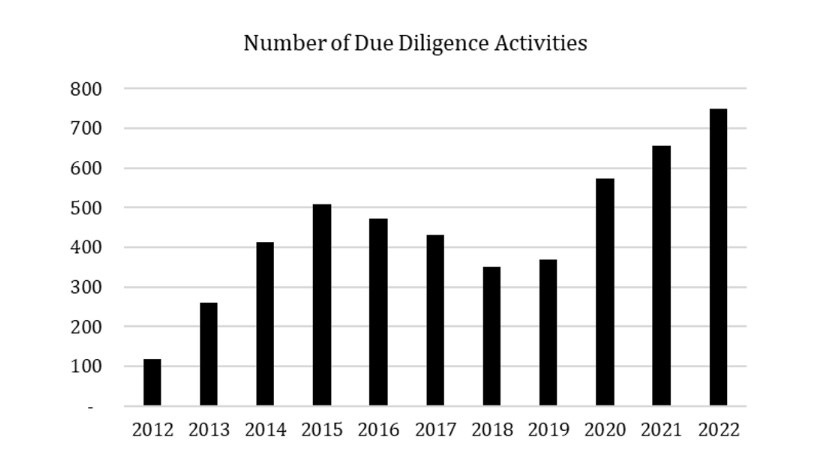

In order to find the right people, or experts, it is important to continue meeting and evaluating both existing and new investment managers. At Star Magnolia Capital, we conduct 400-500 due diligence activities with external investment managers a year.

Source: Star Magnolia Capital

East Rock Capital is a Washington, DC-based multi-family office, which oversees $3 bn and invests primarily in hedge funds and private deals alongside early-stage sponsors. In Capital Allocators’ recent interview, East Rock Capital’s Adam Shapiro said,

I’m going to mention too strategically the best advice I’ve gotten is that 95% of investing is sourcing… And so there’s no such thing as too much sourcing, you just want tons and tons and tons of ideas and you want an engine for producing those ideas the more the better because the more you have, the less smart you need to be.

Interview with East Rock Capital’s Managing Partner, Adam Shapiro

Post-Breeding Grounds for Rising Stars and Families - Capital Allocators with Ted Seides

While we strongly agree with Mr. Adam Shapiro’s views, we also need to know how to select right partners. At Star Magnolia Capital, we try to identify 0-4 new managers a year through a multi-year process. If we assume we meet 400 new managers a year, we select less than 1%. This is far below Yale University’s 5.3% acceptance rate in 2021. Now, you may wonder how we actually select the top 1%. In order to answer your question, we will start a new monthly series called “Finding Experts”. Please make sure that you subscribe to our Substack to receive updates.

Joining MBA Course as a Protagonist

On October 27, 2022, I had the privilege to join Prof. Cohen's MBA Course "How to Not Bankrupt Your Family" virtually. And on February 25, 2023, I finally had a chance to meet Prof. Cohen in Boston during my first trip to the US after the pandemic. Prof. Cohen handed me a copy of our case study signed by the students of his course, which I participated in. This is going to be Star Magnolia Capital's treasure forever.