(Source: CNBC)

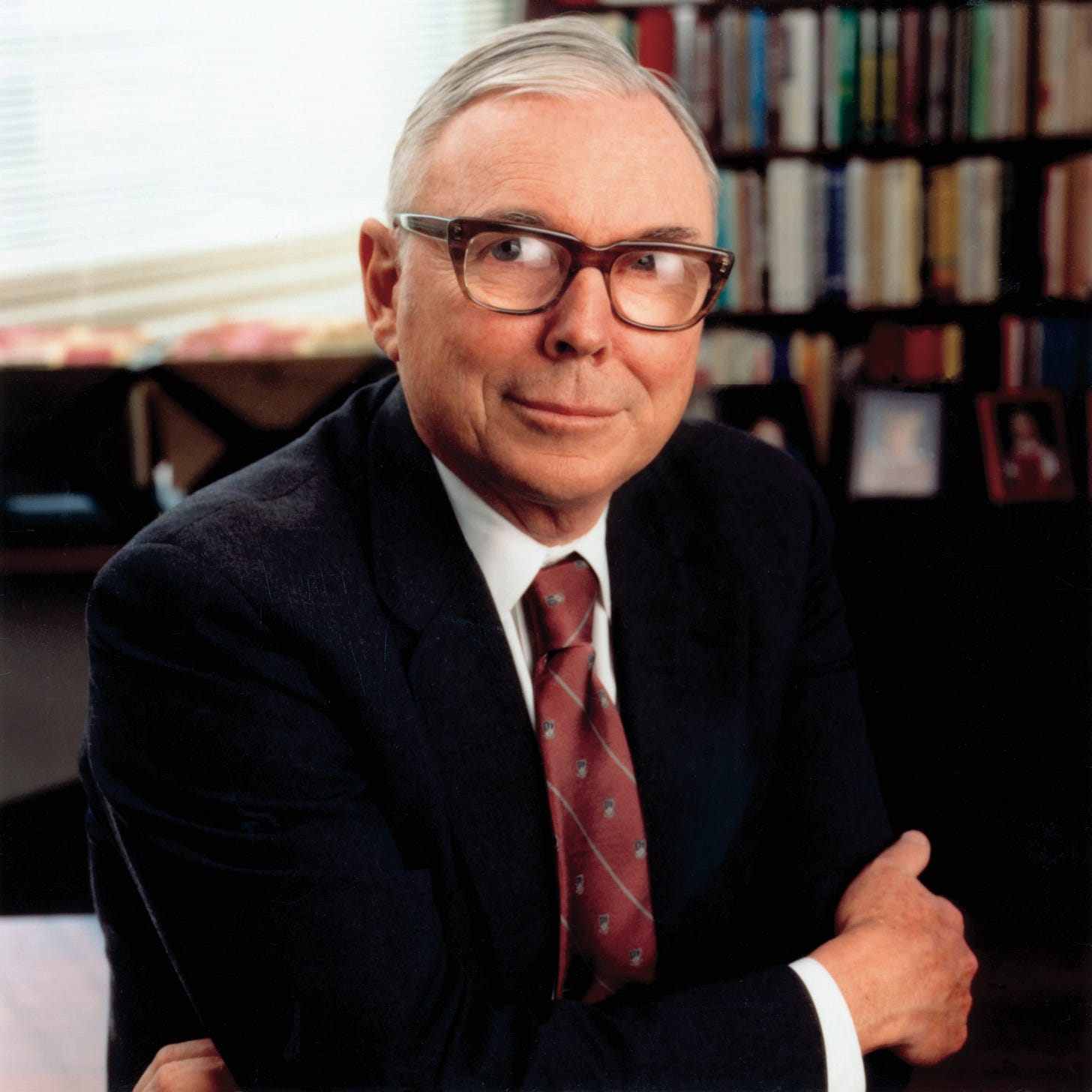

So much ink has been spilled on the life and death of Charlie Munger that I shall not attempt to rehash everything that you can easily google. Rather, a reading of Poor Charlie's Almanack as well selected pieces online reveal a certain key trait of Charlie's in terms of decision making, especially when it came to choosing the right business partner.

Star Magnolia Capital is in the business of people. We want to be become experts at finding experts - this has been our mission since inception. In fact, Star Magnolia Capital’s research team conducts ~700 due diligence activities (including onsite meetings and conference calls) with investment managers every year.

With 99 years under his belt and an extremely successful company (Berkshire Hathaway) built as a result of finding the right partner (Warren Buffett) and building the right team, there are nuggets of gold that we can mine from Charlie's life.

In this article, we wish to zoom in to one aspect of Charlie's wit and wisdom - his approach in choosing the right business partners.

(Source: National Geographic)

It is clear from reading Poor Charlie's Almanack that Charlie’s values were heavily influenced by Confucius. Confucius stressed the cultivation of personal qualities such as benevolence, reciprocity, and filial piety.

“All my life I have admired Confucius. I like the idea of ‘filial piety’, of ideas or values that are taught and duties that come naturally, that should be passed onto the next generation.” - Charlie

As a Singaporean Asian myself, a lot of our culture is also heavily influenced by Confucius. In school, we are taught concepts of filial piety, respectfulness and treating others the way you wish to be treated.

For Charlie, one core idea that helped him throughout his life was this: deliver to the world what you would buy if you were on the other end.

By living by this core idea, Charlie earned the trust he deserved. And that trust was the bedrock upon which Charlie could build, attract and find the right relationships. That trust was his key to a meaningful and well-lived life.

“The acquisition of wisdom is a moral duty.”

This was yet another idea that Charlie gleaned from the teachings of Confucius, which accompanied him well through into his golden years.

Continuous learning was a trait that Charlie possessed, and it was so important to him that his business partner, Warren Buffett, had to possess it in equal measure, if not more.

Let’s dive into the best decision that Charlie made in choosing a business partner.

Trust

Charlie met Warren when he was 35 and the latter was 29 years old. Charlie was headed back to his hometown in Omaha to settle his father’s estate after his father passed away, and was introduced to Warren by a mutual friend.

The both of them hit it off immediately like two peas in a pod. Even after Charlie returned to Los Angeles, his conversations with Warren continued. Back then, telephone and written letters were the main mode of communication. One could say that their letters to each other were longer than lovers’ (since their letters could go up to nine pages!)

No formal contract was required. Both of them saw a kindred spirit in one another, and a lifetime of business partnership was birthed.

“No matter how smart you are, there are smart people out there who can fool you if they really want to. So, be sure you can trust the smart people you work with.” - Ben Graham

There is no short cut to building trust. Time, energy and resources have to be invested in building a relationship, being vulnerable and being interested in someone’s life.

“In your own life what you want to maximize is a seamless web of deserved trust. And if your proposed marriage contract has 47 pages, my suggestion is that you not enter.” - Charlie

Trust is a two-way street. You give, and you get.

At the very start, Warren allowed Charlie to influence him to the extent that it changed his investment philosophy and set the foundation of how Berkshire Hathaway would invest. Previously, Warren liked to buy cheap companies. But Charlie changed his focus to quality companies at fair prices.

Warren also admired Charlie’s “formidable intellect, temperament, and decades of relevant experience, that have made him the virtuoso of business pattern recognition so valued by Buffett.” (Source: Poor Charlie’s Almanack)

Charlie was content at being Warren’s right hand man, even though he was Warren’s senior. While he could have pride himself on 6 years more of wisdom and experience, Charlie instead chose to play to his strengths and let Warren play to his.

(Source: Poor Charlie’s Almanack)

Unsurprisingly, therefore, the two legends built an empire without compromising on their friendship and business partnership.

Wisdom

(Source: CNBC)

“Just as civilization can progress only when it invents the method of invention, you can progress only when you learn the method of learning.” - Charlie

Berkshire Hathaway is one of the most reputable corporations in the world. However, it would not have continued its upward trend without constant improvement or change. To do so, Warren would have had to keep on learning. And that was what he did.

In Poor Charlie’s Almanack, Charlie said that if you watched Warren with a time clock, you’d find half his waking time spent on reading and the rest of that time spent talking one-on-one, either on the telephone or personally, with highly gifted people whom he trusts and who trust him.

Charlie was no less a learning machine. He would quip also that his children think he’s a book with a couple of legs sticking out.

This accumulation of knowledge translated into wisdom where Charlie and Warren could then use to filter and distil businesses that they could bet and hold on to for a long time.

Although it is too simplistic to state that these are the only 2 traits that have led to Berkshire Hathaway’s success, we can certainly conclude that the bedrock of trust and the pursuit of wisdom have been twin pillars of Charlie, Warren and therefore Berkshire’s life.

Charlie and Warren have a spectacular track record of identifying undervalued companies and then either buying large stakes in the public markets or acquiring them outright. Some acquisitions include:

Johns Manville

The Buffalo Evening News

FlightSafety International

NetJets

Shaw Carpet

Benjamin Moore Paint

GEICO

Dairy Queen

Meaningful stakes in public companies that they have purchased include:

The Washington Post

Coca-Cola

Gillette

American Express

(Image: Tree in Yakushima Island in Japan)

Yakushima cedars refer to cedar trees that live for 1,000 years or more. As a result, their roots are deep and intertwined and the trees grow up to 500 metres or more.

Berkshire Hathaway’s approach towards buying and holding their companies can be likened to the growth of the Yaku cedar. The companies are held for a long time, they grow big and tall, and as a result are deeply entrenched in the company’s history and identity.

At Star Magnolia Capital, we serve families to invest with multi-decade time horizon. While we do not invest directly into companies, we build multi-decade relationships with the managers that we invest with, and these managers create history alongside us.

The average length of the relationships we have with our managers is 6.6 years for the currently approved managers compared to 6.3 years for the previously approved managers. We have 12 managers with whom we have over 10 years of relationship. Read more in our Summer 2023 Letter.

Amongst others, two of Star Magnolia Capital’s Principles mirror those of Charlie’s Wisdom and Trust - our unwavering and incessant pursuit of truth (”truth-seeking”), as well as doing good business with good people.

You can read more Notes here.

We hope that as we learn and adopt the same twin pillars that Charlie advocated for, we may also build a great business and retain healthy and thriving relationships in the process.

About the Author

As Persis used to be a lawyer, she mostly works on legal matters for Star Magnolia Capital and also assists for research and/or business development matters. For the most part, she is the Business Manager of Gen Z Group and Next Gen Investors Endowment, investment education subsidiaries of SMC. Persis is new to investing but she is eager to learn and kickstart her investor’s journey alongside the best in the Star Magnolia team. She is also a young mother of a toddler.

The World of Allocators (”WOA”)

World of Allocators (WOA), also known as Capital Allocators China (CAC) is operated by Shanghai Ziben Consulting Management Limited, and is the official licensee of the podcast program “Capital Allocators” by Ted Seides and his company. CAC was established in 2020 with the goal of promoting the long termism and endowment approach of investment in the asset management industry in China. We created an investor community that is eager to share and learn, and we serve as a bridge between domestic and overseas practitioners. As the community grows, we believe World of Allocators reflects better our ambition to unite more like-minded professionals on our platform, regardless where they are based.

WOA Family Office Study Group

WOA is launching Family Office Study Group (the “Study Group”, or “FOSG”). In recent years, we recognize more and more family offices became interested in implementing the endowment approach for their own family’s asset management, but they also face challenges – where is the resource family office can learn? This is exactly the reason why we brought Capital Allocators, which accumulated rich educational contents and resources on the endowment approach, to China. We are establishing the Study Group to share the important and useful resources with fellow family office members and practitioners.

Benefit

There will be three communication groups: Wechat, WhatsApp and Slack. You can join both or only one, but it is important for you to be part of the community so that you will not mise the exclusive opportunity we offer to the family office community.

You will be invited to some exclusive events for family offices organized by Academic Partners

You will receive useful information and resources for the development of your family offices

You will have opportunities to interact with other family offices in China, Singapore and other regions

You can access the exclusive resource library for a family office and endowment approach

You will be invited to apply for exclusive educational activities by WOA and its Academic Partners (additional fees may apply)

Eligibility

Must be an Individual or Institutional Member of WOA

Must be a family member or a professional at a single-family office or a professional at a multi-family office

Must have passion to learn and share with other members in the community

Application Process

Application will be open from Dec 15, 2023 and ongoing basis; and applicants will be notified if they are accepted within 15 days

Contact: Fan Fan (fan.fan@starmagnoliacapital.com)

Application will be reviewed and approved by the Advisory Committee

Applicant must submit the application form and provide necessary information to verify his/her eligibility (on a confidential basis)

Applicant must sign a confidentiality and no-solicitation agreement

Family Office Learning & Sharing Program

The Learning & Sharing Program offers a discussion-style learning, using Harkness Table approach. This requires all participants to actively engage in the sessions. This unique approach of learning is proven to be highly effective to develop creativity and decision-making skills, but not for knowledge-building.

What is the Harkness Table?

The Harkness table, or Harkness method, is a teaching and learning method involving students seated in a large, oval configuration to discuss ideas in an encouraging, open-minded environment with only occasional or minimal teacher intervention. It is in use at many American boarding schools and colleges. Developed at Philipps Exeter Academy, one of the most prominent boarding schools in the United States, the method’s name comes from the oil magnate and philanthropist Edward Harkness, who presented the school with a gift. He is also a major benefactor to Yale University, Harvard University, Columbia University as well as the Metropolitan Museum of Art.

Main Module

Discussion based, mutual learning session by participants, about a specific topic with a pre-assigned learning material

Designed for senior members of an investment team

Meet once a quarter in person

Foundation Module

Hybrid style of lecture and discussion

Designed for a new family office principles with no or some financial knowledge who are interested in the endowment approach

6 sessions

Meet every month in person