Dear Friends and Families,

I trust that your summer is well.

Research Activities Update

During the 2nd quarter, Star Magnolia Capital’s team was busy traveling. In April, we spent one week in Ho Chi Minh City with Cook Pine Capital’s research team for our first joint offsite where we discussed our research philosophy and process together while enjoying local cuisines (Vietnamese are known for dishes influenced by French cuisine during the colonial era). We also met a few local managers and visited their portfolio companies.

After Ho Chi Minh City, Tiffany went on to Manila and Hong Kong. We reunited in Singapore for a few days. We enjoyed a hot and sweaty dinner at East Coast Lagoon Food Village, our favorite and regular spot to enjoy Singapore’s fresh seafood BBQ! (No need to go to Jumbo or No Signboard any more)

After Singapore, I joined Cook Pine Capital’s team in London to meet managers. Then, I went to Munich and Frankfurt for manager meetings and AGM. I came back to China for a week, and visited Beijing and Gansu (Journey to the Northwest). Then, I went back to Singapore where I spent the entire month of June as we are working on a new legal structure. Of course, we had many fruitful meetings in Singapore. The life in Singapore is as predictable as you can imagine.

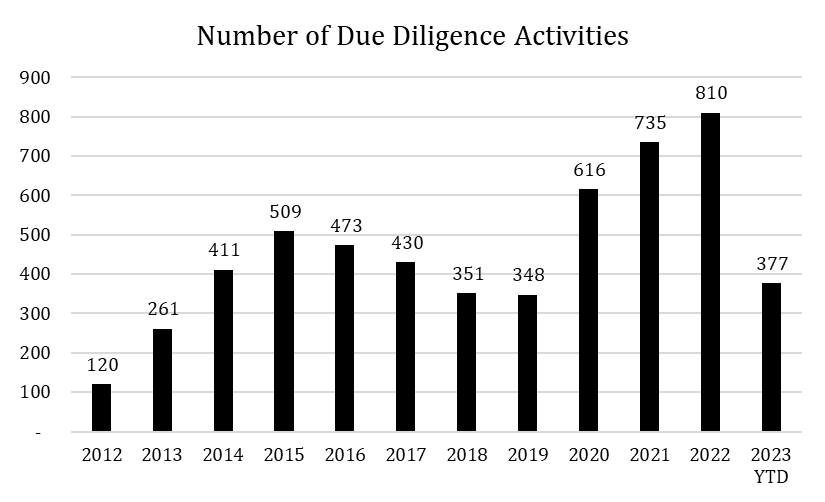

During the first two quarters, we had 377 due diligence activities (meetings, calls, and conferences). We added one new relationship during the same period and now have 41 relationships.

Since 2012, we had 5,441 due diligence activities, or 41.2 every month. We started 52 new relationships and terminated 11 relationships. On average, we approved 3.5 new managers a year while terminating 1.0 relationships.

The average length of the relationships is 6.6 years for the currently approved managers compared to 6.3 years for the previously approved managers. We have 12 managers with whom we have over 10 years of relationship.

Tenth Anniversary

This is actually the first seasonal letter published since we celebrated the 10th anniversary of Star Magnolia Capital. So, let us talk a little bit about our origin.

Star Magnolia is a flowering tree, native to the Ise Bay area of central Honshu, the largest island in Japan. The small fuzzy buds appear in the coldest time of the winter, and in early spring, the buds burst open into a starburst of white flowers, each flower a little 12-petaled star in itself.

The seed of Star Magnolia Capital was produced in 2006 when I joined Cook Pine Capital as a new associate. Cook Pine Capital was founded by Yumi and Eiich Kuwana in 2004 to serve some of the wealthiest families in the world by managing their heritage over the next decades, if not centuries. Eiich told me that the foundation of Cook Pine Capital was trust—we work with people whom we trust and who trust us. He often said to me that “we are in the people business, and we do a good business with good people.” His teaching is the foundation of Star Magnolia Capital today.

The seed was eventually planted in Hong Kong in 2012 as I decided to move to Hong Kong to pursue my entrepreneurial passion. Star Magnolia Capital officially started on Nov 5, 2012 at a windowless room at the Centre’s rental office with no employee but myself. We called our business a “multi-family office”, a concept very new to Asia, especially China, while a private banking business was growing rapidly to meet the increasing demands from the new wealth being created in China. There were several single family offices in Hong Kong to manage the wealth of real estate tycoons, but very few multi-family offices. There was almost none existing in China. Today, family offices are a new trend as many new rich families, who have finally realized that private bankers are working for their banks, not for clients, need a better solution for their wealth.

Starting from 2016, I started spending more time in Shanghai. In 2019, we eventually opened a new research office in Shanghai. In 2021, we also opened a research office in Singapore. As of July 26, 2023, Star Magnolia Capital has 6 full-time members across three cities. During the last 10 years, we bid farewells to 8 members. We sincerely thank both current and former members of the House of Mulan.

Star Magnolia Capital serves families to invest with multi-decade time horizon. During the first decade, we made many mistakes and learned from them, creating strong foundations for the following decades. Thank you very much for your support for the past years, and for many years to come.

Yours respectfully,

Shinya Deguchi

Read previous posts:

Summer 2022 Letter

7,200 Years Old Cedar Right before returning to Shanghai (Read: Happy Quarantine’s Day) in 2020, I had an opportunity to visit Yaku Island in Japan. The island sits off the southern coast of Kyushu Island and her unique remnant of warm/temperate ancient forest has been a natural World Heritage Site since 1993, especially known for very old Japanese ceda…

Love these tables and data as they show how much efforts and time the time put in and are the verification of SM's approach! With such a large volume of activies, I was wondering if the team use any tech solution to manage your investment activities? I assume the team also has a portfolio management systsem in place to aggregate different portfolio data from different custodians using by the managers hired by SM, is that system integrated with your research activies? Anyway it will be much appreciated to hear from you on these. Thanks