A Happy New Year!

Year 2024

It has been a reasonably busy and productive year for us, marked by an exciting milestone—our expansion into Singapore. This has allowed us to engage with new families who believe that our endowment approach can help them overcome the three-generation problem of wealth.

In February, we launched our very own Investoon, inspired by the HBS case study written in 2021. We believe that communication is one of the most critical yet often overlooked elements in building lasting relationships. The Investoon serves as a creative tool to help us connect with the next generation of investors and families.

Harvard Business School - Star Magnolia Capital: Becoming Experts at Finding Experts

INVEST! (Star Magnolia Capital: Becoming Experts at Finding Experts) - Chapter 1

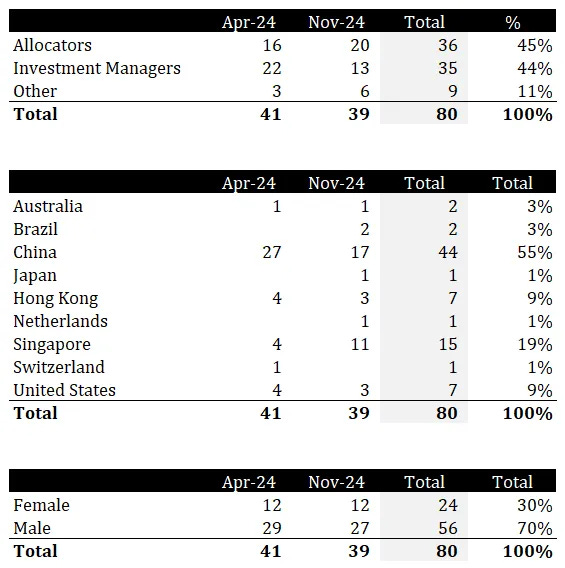

We also successfully organized two Present Value of the Future Summits in Spring (April) and Fall (November), welcoming 80 guests from around the world. These summits facilitated meaningful discussions on essential topics such as asset allocation, manager selection, and organizational culture. Our Fall summit was particularly unique, as we chose not to feature keynote speakers, believing that every participant brought invaluable insights and perspectives to the table.

We are excited to share that our next Present Value of the Future Summit will take place in Shanghai this April. We look forward to continuing these important discussions and fostering valuable connections.

Summit

The Present Value of the Future Summit. The summit is an invitation-only event for patient investors with a long-term mindset to learn and share. There will be 6-7 sessions with various topics. Each session is organized with a 20-minute expert sharing and 45-minute small group discussions (6-8 people). The members of the groups in the morning will be di…

Next Gen Investors Endowment

In 2018, Tiffany originated the idea of creating a platform to kickstart the next generation’s investor journey. This vision was formalized in 2021 with the incorporation of the Endowment as a non-profit organization in Singapore. Among its initiatives, the Endowment runs a student investment club where members gain both theoretical knowledge and practical experience in long-term investing.

Over the past five years, the Endowment has raised over SGD 500,000 from generous donors, including ShawSpring Partners, Arisaig Partners, Overlook Investments, Discerene Group, and Veddis. During this time, it has also recruited more than 200 members who actively manage real-money portfolios. The profits generated by these portfolios are used to fund scholarships for members from underprivileged backgrounds.

One of our first scholars, Kayla Bai, recently graduated from the program after four years. She is expected to join Star Magnolia Capital in 2025 following her probation period—a testament to the program’s success and impact.

The Endowment is governed by a board that includes industry leaders such as Mr. Allen Xiao from Amundi US and Mr. Gordon Yeo from Arisaig Partners. (You can read more about them here.) The day-to-day operations of the Endowment are managed by Persis Hoo, who also contributes to Family Relations and Legal matters at Star Magnolia Capital.

Philanthropy remains a cornerstone of our operations, and we are committed to continuing our support for the Endowment as it nurtures the next generation of investors.

Research Activity Updates

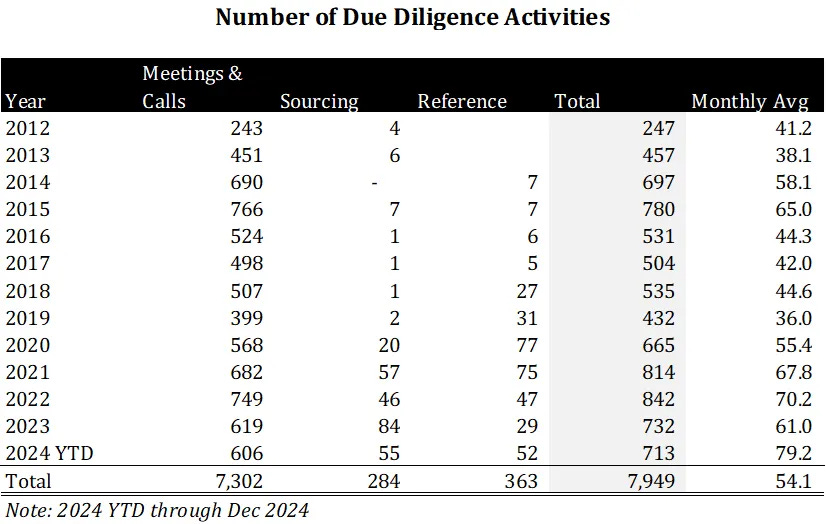

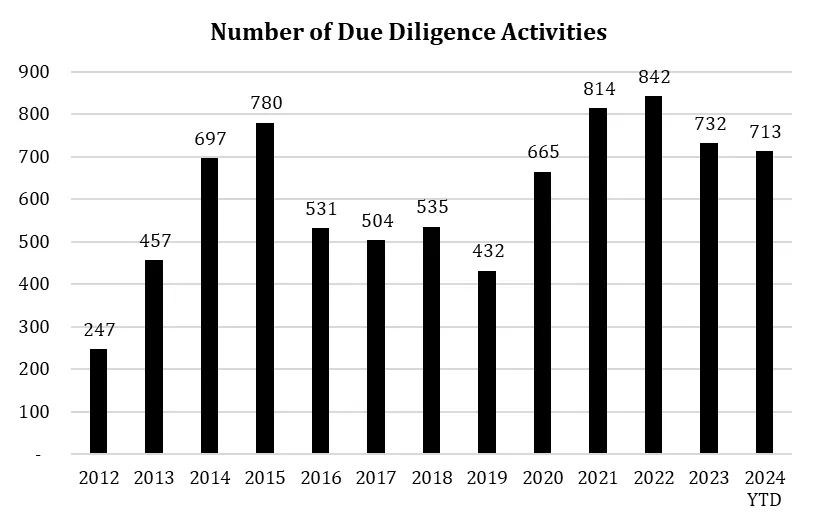

The House of Mulans had a busy and productive year. In total, we conducted 713 Due Diligence Activities, including 606 meetings and calls. Additionally, we engaged in frequent reference activities as we approved several new investment managers during the year.

Building long-lasting relationships with our investment managers is a top priority. To achieve this, we thoroughly evaluate every aspect of potential managers before making any investments. Of course, our commitment doesn’t end there—we continue to monitor our investment managers very closely to ensure alignment with our standards and objectives.

In 2024, we approved four new investment managers and ended relationships with two. Both terminated relationships began in 2012 and lasted approximately 13 years—one termination was voluntary, while the other was involuntary.

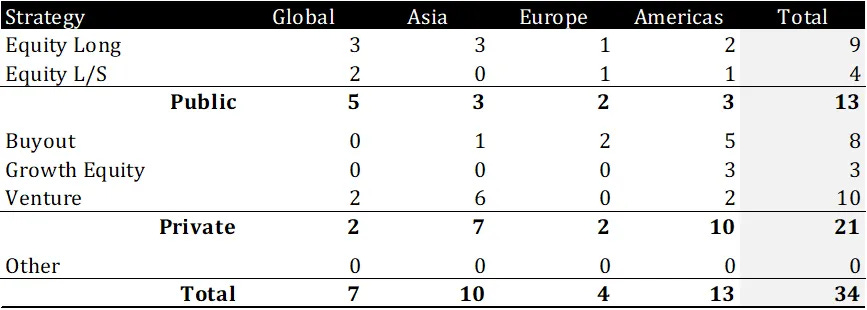

Since our inception, we have approved a total of 47 investment managers and terminated 13, leaving us with 34 active relationships today. These consist of 13 public market managers and 21 private market managers.

Conclusion

Thank you very much for your continuous support. If you have plans to visit Singapore or Shanghai, please don’t hesitate to send us an email anytime. We would be delighted to take you to our favorite local spots to enjoy delicious (and affordable) cuisines while sharing great food and conversation.

606 meetings! That's incredible.