Friends and Families,

What’s the Real Secret?

People, People, People.

Real secret relationships with absolutely the highest quality people.

Source: Former CIO of Yale, David Swensen’s handwritten notes emphasized an important lesson.

Former Yale CIO David Swensen emphasized that the endowment approach begins not with asset allocation, but with people. Without exceptional individuals, allocation strategies are not meaningful.

Recently, Shinya had the privilege of spending quality time with Richard Lawrence of Overlook in Singapore and Shanghai. Richard represents the "absolutely highest quality people" in investing—a rare combination of intellect, integrity, and enduring conviction.

Shinya first met Richard 12 years ago, shortly before moving from New York to Hong Kong. A friend provided an email address with a simple note: “He’s good. You should talk to him.” Curious, Shinya introduced himself briefly via email. Richard’s assistant replied shortly after: “Mr. Lawrence can meet you on March 25. Can you come?”

At that time, Shinya had recently founded Star Magnolia Capital, advising just a few initial families, including his own, but his primary goal was clear: find exceptional Asian investment managers for long-term partnerships.

The initial meeting with Richard was brief and direct. Richard greeted him succinctly, “How can I help you?” Rather than posing specific questions, Shinya chose to openly share his story and vision. After a focused 30-minute conversation, Richard ended the meeting as he had another appointment.

Initially uncertain about the outcome, Shinya soon received an email containing detailed information about Overlook’s founding and its investment model. Richard had listened closely and recognized Shinya’s genuine potential to understand Overlook’s culture.

Richard founded Overlook in 1991 to counter institutional short-termism, focusing on long-term, high-conviction investments. He established Five Essential Business Practices:

Overlook wasn’t just a fund—it was a philosophy. Richard had founded it in 1991 after becoming disillusioned with the short-termism that plagued institutional investing. He wanted to build a firm grounded in conviction, not compromise; a firm that concentrated in a few great companies and held them for decades, not quarters. There were no marketing teams. No glossy decks. Just values, structure, and performance.

What stood out even more were Richard’s Five Essential Business Practices—guiding principles that shaped Overlook from the beginning:

Legal Cap on Subscriptions

Focused & Independent Structure

Outlaw Greed

Embrace Diversity

Structure Ownership for Long Duration

(source: Overlook’s presentation at Harvard Business School Club of Shanghai in May 2025)

These deeply ingrained principles resonated with Shinya, aligning closely with Star Magnolia Capital’s own evolving values—limiting the number of families to work with, independence, rejecting greed, embracing diversity, and designing for permanence.

It takes a lot of effort and thought to build a business that can endure 30 years or more. Not just resisting trends, but consciously designing for permanence. That kind of business is built on people.

Since that first meeting, Richard and Shinya have had many conversations over the years. Never frequent. Never transactional. Just real. The kind of relationship that compounds quietly.

And that’s the real secret:

People like Richard shape how you think about investing, and they shape how you think about life.

Spring 2025 Recap

On April 10, 2025, we hosted the third Present Value of the Future summit in Shanghai, bringing together 63 participants from seven countries and regions. Nearly half of the attendees were allocators—primarily from family offices—who joined us to explore how long-term thinking can shape better capital allocation.

We’re encouraged by the growing interest in this initiative. As attendance increased by over 50% from the previous summit, we expanded the format to include two rooms and covered a broader set of forward-looking topics relevant to long-term investment decisions.

That said, we also want to acknowledge where we fell short. While there was progress, only 33% of participants were female, and we didn’t reach our goal of a 50:50 gender balance. Creating a more inclusive community remains an important area for improvement, and one we are committed to addressing going forward.

From a financial standpoint, we aim to keep the summit lean and mission-aligned.

Ticket sales revenue totaled USD 7,485.27

Operating expenses were USD 5,209.12

As shared during the event, the remaining balance of USD 2,276.15 was donated to the Next Gen Investors Endowment

We deeply appreciate your participation, energy, and feedback. This gathering is a co-created space, and every idea and suggestion helps us shape it better.

The next summit will take place on November 7, 2025.

More details will be shared in the coming weeks—please stay tuned.

Research Activity Updates - Q1 2025

The House of Mulans had another busy and productive quarter, continuing our commitment to deep, thoughtful research and long-term relationship building.

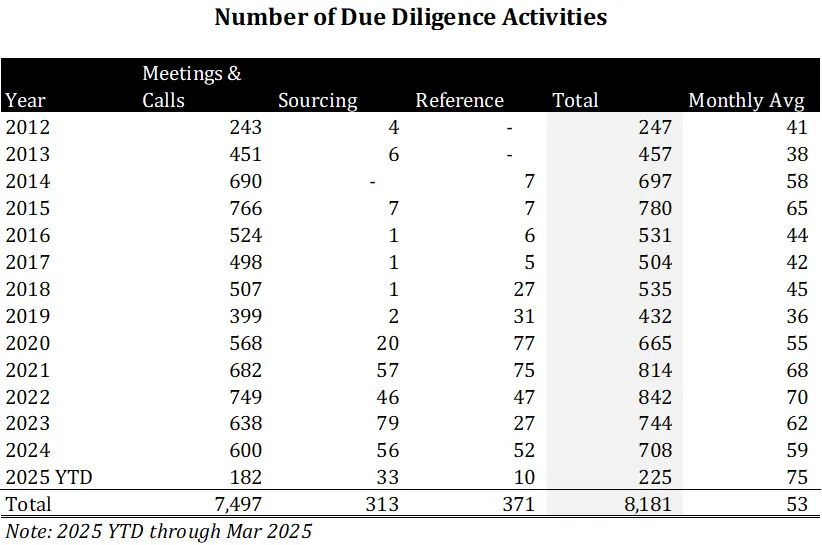

Over the first quarter of 2025, we conducted 225 due diligence activities, including 182 meetings and calls, alongside numerous reference checks. These activities supported several important approvals and re-underwritings of our existing managers. We take pride in the rigor of our process: we don’t just evaluate performance—we evaluate people, culture, decision-making frameworks, and alignment.

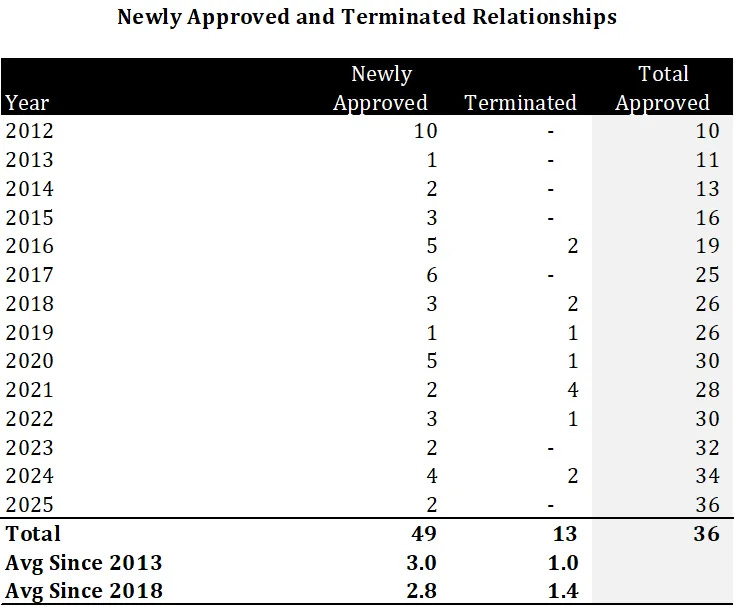

In Q1, we approved two new investment managers. While that number might seem modest, it is very meaningful for us. Historically, we have approved just 2.8 managers per year, so the first quarter marked an exceptionally active start. Since inception, we have approved 49 managers and terminated 13, leaving us with 36 active relationships today—14 in public markets and 22 in private markets.

On the Road: Research Trips with Families

We believe that investment research is not just analytical—it’s immersive. That’s why we often travel with family, blending due diligence with local exploration. In Q1, we made three major research trips:

January – San Francisco & Los Angeles

CHAN Yong, Shinya, and Tiffany conducted onsite due diligence on a venture manager that we ultimately approved during the quarter. They also met with several current and prospective managers. Beyond the meetings, the team enjoyed riding in Waymo through San Francisco and took a memorable two-hour walk-and-talk with a manager along the San Francisco Bay Trail. The conversations were long-term in spirit, as was the stride.

February – Mumbai & Jaipur

Shinya and Tiffany traveled to India to visit companies and conduct household visits to understand India’s consumer landscape with Arisaig Partners. We also spent time to explore new relationships. In Mumbai, Shinya made a classic value investor choice: Sea Green South Hotel, USD 90 per night. Most other hotels felt unreasonably expensive. He arrived around midnight to a dimly lit, shuttered entrance. It had the feel of a roadside motel you might never check out of—but the room was clean and decent. The walls, however, were remarkably thin. Still, as Shinya often says, “If we invest like locals, we should live like locals.”

That philosophy extends to food. Shinya explored local eateries with enthusiasm, including Panecham Puriwala, a no-frills puri shop where he was the only foreigner. Locals kindly guided him through the ordering process. A plate of Mixed Puri with Mango Lassi cost INR 150 (USD 1.76)—certainly more expensive than eight years ago, but still an incredible value.

March – Yunnan & Sichuan

After visiting Liangjing’s hometown near Kunming (please watch the video below), the team continued on to Chengdu to visit a condiment company and its new factory. Chengdu, the capital of Sichuan Province and home to over 21 million people, is famous for its food—particularly its mala flavors that combine chili peppers and Sichuan peppercorns.

The culinary highlight? Sichuan-style hotpot with fresh duck blood. While duck blood itself has a mild flavor, it soaks in the intense mala broth during cooking. Its silky texture and fiery aroma were, in Shinya’s words, “a one-way ticket to heaven.”

Organization Updates

In April, Shinya and Tiffany traveled to Kunming, China, accompanied by donors who actively support the Next Gen Investors Endowment—a non-profit organization established to kickstart everyone’s investor journey.

Kunming, the provincial capital of Yunnan, served as the starting point for a very meaningful journey: a visit to the hometown of Liangjing XIAO, one of Next Gen’s scholarship recipients. The drive took over four hours by minibus through the hills of Yunnan. Upon arrival, we were warmly welcomed by Liangjing’s entire family and treated to an unforgettable meal prepared by her mother, featuring traditional local dishes.

The visit was a powerful reminder of why this work matters. Liangjing’s family has been under significant financial pressure following the sharp decline in beef prices across China—an economic shift that directly impacted their household income. Without support from the Next Gen Investors Endowment, it would have been nearly impossible for them to continue funding Liangjing’s education.

This is what Next Gen is about: creating access, lifting potential, and connecting communities through investing—not just financially, but intergenerationally.

Watch on Youtube

Next Gen Investors Endowment is supported by prominent long-term investment managers such as Arisaig Partners, Discerene Group, Overlook Investments Group, ShawSpring Partners as well as family offices such as Instinct Asset Management and Veddis. If you are interested in supporting their causes, financially or emotionally, please reach out to them via www.nextgeninv.org.

Conclusion

Thank you very much for your continuous support. If you have plans to visit Singapore or Shanghai, please don’t hesitate to send us an email anytime. We would be delighted to take you to our favorite local spots to enjoy delicious (and affordable) cuisines while sharing great food and conversation.