Not Sexy, but as Attractive as Mary

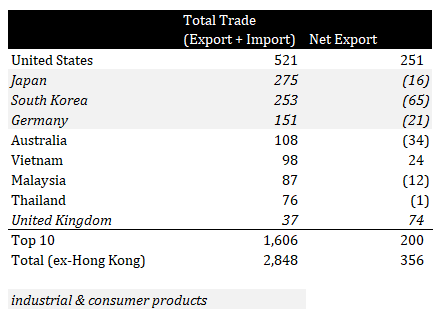

President Trump ignited the fire of the trade war between China and the United States as he criticized China of not buying the US products. The problem is… the US does not produce what China needs. On the other hand, China is a net importer (i.e., they import more than export) for Japan, South Korea and Germany as these countries maintain industrial and engineering edges over China. For Germany, in particular, China became the most important export partner. (and China doesn’t complain about Germany’s buying less from China)

Germany’s Export Partners, Eur mm

Even for the Japanese, “Made in Germany” means the highest quality of products, especially in Industrial, Automotive, and Chemicals. Prof. Bernd Venohr showed that there are as many as 1,500 world market-leading companies in Germany across sectors like Industrial, Automotive, Consumer, Construction et al., however, it is quite interesting to notice that more than 50% of those leaders are in Industrial.

Germany’s World Market Leaders

Why? Unlike an automotive manufacturer which needs a large scale to operate, industrial companies focus more on niche areas and the large scale does not always mean an advantage. While small-scale companies in the automotive industry captures only 12% of turnover, electrical and mechanical engineering companies take almost 50% of the total revenue in the segments (€400 bn in 2016 in Germany). Those small-scale enterprises in German-speaking countries (Germany, Austria and Switzerland, or DACH altogether), commonly called mittelstands, are the backbone of DACH’s industrial superiority.

According to Prof. Venohr, , there are than 3 million mittelstands and most of them (99.65%) are very small (revenue below €50 mm and enterprise value between €20-100 mm).

Small Buyout Opportunities

Over the last 2-3 years, we became very interested in the lower middle market buyout opportunities in the DACH region. Many mittelstands are still owned by 2nd, 3rd or 4th generation families and maintain industrial and engineering edges. By keeping company small, they were able to maintain their culture and standard over many years, but the size is becoming a double-edged sword as they need to compete against international players in the area they are not very good at: marketing and business development. We don’t want to overgeneralize this, but German management is very often more quiet and technical-driven than American counterpart. (both become very talkative after drinking 3 pints of beer… well, it must be Made in Germany) As shown below, over the last decade, German companies ventured abroad in companies like China, UK and US, however, it is still not easy for the mittelstands to expand their presence into other countries by themselves.

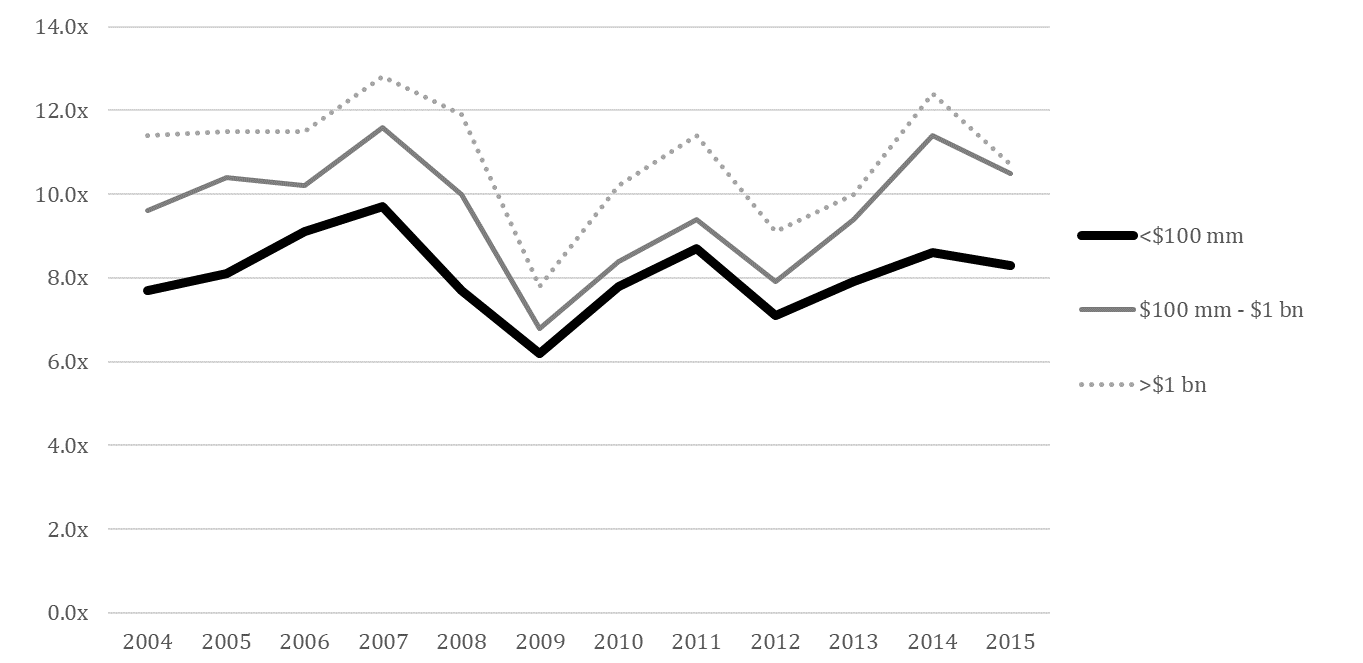

Many lower-middle market mittelstands are trading at inadequately low valuation today. Compared to the competitive US markets where average valuation is 8-12x EV/EBITDA, there are many transactions at 4-8x EV/EBITDA for the same, or potentially higher quality, businesses in Germany.

European M&A Valuation Multiples (EV/EBITDA) by Deal Value

DACH region has been a relatively challenging market for traditional private equity managers as there were not many transactions in the past. As shown below, the value of the buyout transaction jumped in 2016 as a result of the acquisition of Kuka (Germany’s automation company) by Midea (China’s consumer product manufacturer), but except for the transaction, it has been subdued.

In order to succeed in the buyout opportunities in DACH region, you cannot use the same playbook used in the Anglo-Saxon markets. It is not the money, but the culture which matters most. When you approach a father-and-son management team who worked closely with the local employees for decades, you must respect their culture and history. It takes years to build a relationship with the family before they decided to sell the company to you. In many cases, you want to keep them as a minority owner of the company so that they can benefit from the transaction while you take the control of the business. It is also important to know that you cannot deploy a lot of capital as these companies are small. The mittelstands are not as attractive as Mary the American Girl, but still, have something to attract us. That’s all needed to generate good returns over the next 10 years.

There’s Something About Mary (1998)

There’s Something About Mary is a 1998 American romantic comedy film. Ted was a geek in high school, who was going to go to the prom with one of the most popular girls in school, Mary. The prom date never happened, because Ted had a very unusual accident. Thirteen years later he realizes he is still in love with Mary, so he hires a private investigator to track her down. That investigator discovers he too may be in love with Mary, so he gives Ted some false information to keep him away from her. But soon Ted finds himself back into Mary's life, as we watch one funny scene after another. (source: IMDb)